Page 50 - EE Times Europe March 2022

P. 50

50 EE|Times EUROPE

SEMICONDUCTOR INDUSTRY

Chip Market Heading Toward Recession,

Analyst Warns

By John Walko

he semiconductor industry is heading “Such ‘on-shoring’ of production is the

for its next downturn, Malcolm Penn, biggest post-crash recovery risk,” Penn said.

CEO of Future Horizons, warned in He added that “double ordering” is rife and

T his annual forecast for the sector, that shipments are running way above the 8%

delivered online during IFS2022. trend. This activity will likely result in global

“It is simply a question of when: the fourth overcapacity as demand settles back — and

quarter of this year or the first quarter of when users start burning off inventory, orders

2023,” predicted Penn, a highly respected ana- will dry up and the currently healthy ASPs

lyst who has tracked semiconductor industry will inevitably come down, he warned.

trends for many years. “When the bubble bursts, unit shipments

“There are no soft landings,” he warned. plummet first, followed by a collapse in the

Penn posited that the global semiconductor average selling prices,” Penn noted. “So don’t Future Horizons’

market would grow by roughly 10% this year. be surprised if the market goes negative — it Malcolm Penn

That would represent better performance more often does than not.

than the 8.8% recently forecast by World “Enjoy it while it lasts, because the long- But Penn argues that the 26% improvement

Semiconductor Trade Statistics (WSTS) but term IC ASP growth rate is zero,” he added. in 2021 was not a big deal when viewed in

comes in just under the performance forecast And when collapse does arrive, it will be historical terms.

by another analyst group, IC Insights. “sudden and sharp.” What could be the 17th chip market

“All the signs of a recession are there; the Penn disagrees with those in the industry downturn will not be fueled by specific market

market is overheating, and the road ahead is who argue that the situation is “different this drivers such as 5G, AI, or other “sexy stuff,”

stony,” said Penn. time.” Those who hold this view see only the he said, noting that the semiconductor sector

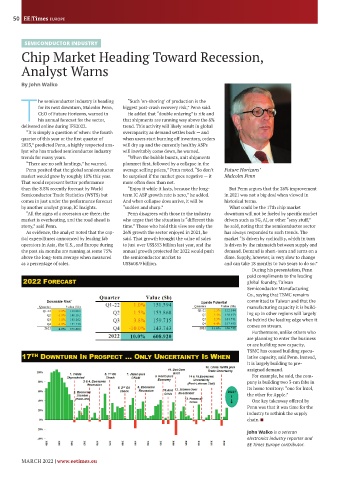

As evidence, the analyst noted that the cap- 26% growth the sector enjoyed in 2021, he has always responded to such trends. The

ital expenditures announced by leading fab said. That growth brought the value of sales market “is driven by cyclicality, which in turn

operators in Asia, the U.S., and Europe during to just over US$553 billion last year, and the is driven by the mismatch between supply and

the past six months are running at some 75% annual growth projected for 2022 would push demand. Demand is short-term and turns on a

above the long-term average when measured the semiconductor market to dime. Supply, however, is very slow to change

as a percentage of sales. US$608.9 billion. and can take 18 months to two years to do so.”

During his presentation, Penn

paid compliments to the leading

global foundry, Taiwan

Semiconductor Manufacturing

Co., saying that TSMC remains

committed to Taiwan and that the

manufacturing capacity it is build-

ing up in other regions will largely

be behind the leading edge when it

comes on stream.

Furthermore, unlike others who

are planning to enter the business

or are building new capacity,

TSMC has ceased building specu-

lative capacity, said Penn. Instead,

it is largely building to pre-

assigned demand.

For example, he said, the com-

pany is building two 3-nm fabs in

its home territory: “one for Intel,

the other for Apple.”

One key takeaway offered by

Penn was that it was time for the

industry to rethink the supply

chain. ■

John Walko is a veteran

electronics industry reporter and

EE Times Europe contributor.

MARCH 2022 | www.eetimes.eu