Page 47 - EE Times Europe Magazine | April2019

P. 47

EE|Times EUROPE — Boards & Solutions Insert 47

Putting AI into the Edge Is a No-Brainer; Here’s Why

SOURCING AI CHIPS: IN-HOUSE OR THIRD PARTY?

Companies that manufacture smartphones and other devices vary in

their approaches to obtaining edge AI chips, with the decision driven

by factors such as phone model and, in some cases, geography. Some

buy application processor/modem chips from third-party providers,

such as Qualcomm and MediaTek, which together captured roughly

60% of the smartphone SoC market in 2018.

Both Qualcomm and MediaTek offer a range of SoCs at various

prices; while not all of them include an edge AI chip, the higher-

end offerings (including Qualcomm’s Snapdragon 845 and 855 and

MediaTek’s Helio P60) usually do.

At the other end of the scale, Apple does not use external AP chips

at all: It designs and uses its own SoC processors, such as the A11, A12,

and A13 Bionic chips, all of which have edge AI.

Other device makers, such as Samsung and Huawei, use a hybrid

strategy, buying some SoCs from merchant market silicon suppliers and

using their own chips (such as Samsung’s Exynos 9820 and Huawei’s

Kirin 970/980) for the rest.

OVER 50 AI ACCELERATOR COMPANIES VYING FOR EDGE AI

IN ENTERPRISE AND INDUSTRIAL

If edge AI processors used in smartphones and other devices are so

great, why not use them for enterprise applications, too? This has, in

fact, already happened for some use cases, such as for some autono-

mous drones. Equipped with a smartphone SoC application processor,

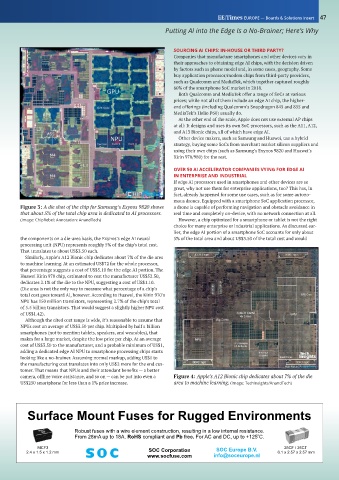

Figure 3: A die shot of the chip for Samsung’s Exynos 9820 shows a drone is capable of performing navigation and obstacle avoidance in

that about 5% of the total chip area is dedicated to AI processors. real time and completely on-device, with no network connection at all.

(Image: ChipRebel; Annotation: AnandTech) However, a chip optimized for a smartphone or tablet is not the right

choice for many enterprise or industrial applications. As discussed ear-

lier, the edge AI portion of a smartphone SoC accounts for only about

the components on a die-area basis, the Exynos’s edge AI neural 5% of the total area and about US$3.50 of the total cost and would

processing unit (NPU) represents roughly 5% of the chip’s total cost.

That translates to about US$3.50 each.

Similarly, Apple’s A12 Bionic chip dedicates about 7% of the die area

to machine learning. At an estimated US$72 for the whole processor,

that percentage suggests a cost of US$5.10 for the edge AI portion. The

Huawei Kirin 970 chip, estimated to cost the manufacturer US$52.50,

dedicates 2.1% of the die to the NPU, suggesting a cost of US$1.10.

(Die area is not the only way to measure what percentage of a chip’s

total cost goes toward AI, however. According to Huawei, the Kirin 970’s

NPU has 150 million transistors, representing 2.7% of the chip’s total

of 5.5 billion transistors. That would suggest a slightly higher NPU cost

of US$1.42).

Although the cited cost range is wide, it’s reasonable to assume that

NPUs cost an average of US$3.50 per chip. Multiplied by half a billion

smartphones (not to mention tablets, speakers, and wearables), that

makes for a large market, despite the low price per chip. At an average

cost of US$3.50 to the manufacturer, and a probable minimum of US$1,

adding a dedicated edge AI NPU to smartphone processing chips starts

looking like a no-brainer. Assuming normal markup, adding US$1 to

the manufacturing cost translates into only US$2 more for the end cus-

tomer. That means that NPUs and their attendant benefits — a better

camera, offline voice assistance, and so on — can be put into even a Figure 4: Apple’s A12 Bionic chip dedicates about 7% of the die

US$250 smartphone for less than a 1% price increase. area to machine learning. (Image: TechInsights/AnandTech)

Surface Mount Fuses for Rugged Environments

Robust fuses with a wire element construction, resulting in a low internal resistance.

From 28mA up to 18A. RoHS compliant and Pb free. For AC and DC, up to +125 C.

o

MCF3 SOC Corporation SOC Europe B.V. 25CF / 25CT

2.4 x 1.5 x 1.2 mm 6.1 x 2.57 x 2.57 mm

www.socfuse.com info@soceurope.nl