Page 46 - 23_EETE_03

P. 46

46 EE|Times EUROPE

THE INDUSTRY

Tracking 2022’s US$38B in Semiconductor

Investments for Startups

By Ahmed Ben Slimane, Strategic Semiconductors

espite the challenges posed by the

pandemic-induced semiconductor

shortage, ongoing war in Ukraine and

Descalating trade tensions between

China and the U.S., many semiconductor

companies still managed to raise substantial

funds in 2022, collectively raising over

US$38.8 billion.

China and the U.S. are among the top

semiconductor-producing nations in the world,

both investing heavily in the industry. However,

recent tensions between the two countries have

resulted in increased scrutiny and limitations

on semiconductor trade between them, causing

a decline in trade activities within the semicon-

ductor industry.

The venture-capital ecosystem trend has

been toward lower transaction values and the

participation of more traditional players. This

can be attributed to high interest rates, more

stringent deal conditions, and the impact of

fluctuating macro-economic factors.

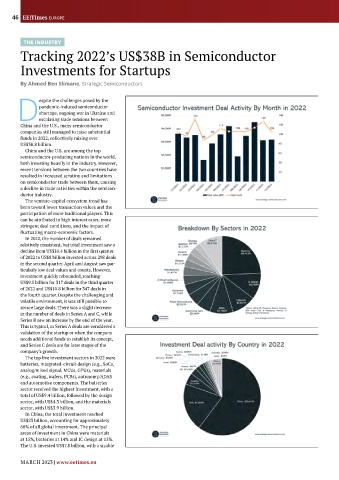

In 2022, the number of deals remained

relatively consistent, but total investment saw a

decline from US$10.4 billion in the first quarter

of 2022 to US$8 billion invested across 298 deals

in the second quarter. April and August saw par-

ticularly low deal values and counts. However,

investment quickly rebounded, reaching

US$9.5 billion for 317 deals in the third quarter

of 2022 and US$10.8 billion for 347 deals in

the fourth quarter. Despite the challenging and

volatile environment, it was still possible to

secure large deals. There was a slight decrease

in the number of deals in Series A and C, while

Series B saw an increase by the end of the year.

This is typical, as Series A deals are considered a

validation of the startup or when the company

needs additional funds to establish its concept,

and Series C deals are for later stages of the

company’s growth.

The top five investment sectors in 2022 were

batteries, integrated-circuit design (e.g., SoCs,

analog/mixed signal, MCUs, GPUs), materials

(e.g., coating, wafers, PCBs), autonomy/ADAS

and automotive components. The batteries

sector received the highest investment, with a

total of US$9.4 billion, followed by the design

sector, with US$4.3 billion, and the materials

sector, with US$3.9 billion.

In China, the total investment reached

US$23 billion, accounting for approximately

60% of all global investment. The principal

areas of investment in China were materials

at 15%, batteries at 14% and IC design at 13%.

The U.S. invested US$7.8 billion, with a sizable

MARCH 2023 | www.eetimes.eu