Page 13 - EETimes Europe June 2021

P. 13

EE|Times EUROPE 13

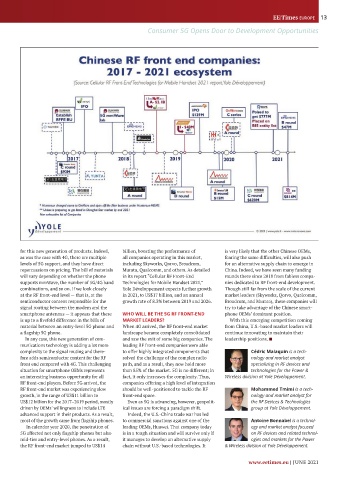

Consumer 5G Opens Door to Development Opportunities

for this new generation of products. Indeed, billion, boosting the performance of is very likely that the other Chinese OEMs,

as was the case with 4G, there are multiple all companies operating in this market, fearing the same difficulties, will also push

levels of 5G support, and they have direct including Skyworks, Qorvo, Broadcom, for an alternative supply chain to emerge in

repercussions on pricing. The bill of materials Murata, Qualcomm, and others. As detailed China. Indeed, we have seen many funding

will vary depending on whether the phone in its report “Cellular RF Front-End rounds there since 2018 from fabless compa-

supports mmWave, the number of 5G/4G band Technologies for Mobile Handset 2021,” nies dedicated to RF front-end development.

combinations, and so on. If we look closely Yole Développement expects further growth Though still far from the scale of the current

at the RF front-end level — that is, at the in 2021, to US$17 billion, and an annual market leaders (Skyworks, Qorvo, Qualcomm,

semiconductor content responsible for the growth rate of 8.3% between 2019 and 2026. Broadcom, and Murata), these companies will

signal routing between the modem and the try to take advantage of the Chinese smart-

smartphone antennas — it appears that there WHO WILL BE THE 5G RF FRONT-END phone OEMs’ dominant position.

is up to a fivefold difference in the bills of MARKET LEADERS? With this emerging competition coming

material between an entry-level 5G phone and When 4G arrived, the RF front-end market from China, U.S.-based market leaders will

a flagship 5G phone. landscape became completely consolidated continue innovating to maintain their

In any case, this new generation of com- and saw the exit of some big companies. The leadership positions. ■

munications technology is adding a lot more leading RF front-end companies were able

complexity to the signal routing and there- to offer highly integrated components that Cédric Malaquin is a tech-

fore adds semiconductor content for the RF solved the challenge of the complex radio nology and market analyst

front end compared with 4G. This challenging path, and as a result, they now hold more specializing in RF devices and

situation for smartphone OEMs represents than 85% of the market. 5G is no different; in technologies for the Power &

an interesting business opportunity for all fact, it only increases the complexity. Thus, Wireless division at Yole Développement.

RF front-end players. Before 5G arrived, the companies offering a high level of integration

RF front-end market was experiencing slow should be well-positioned to tackle the RF Mohammed Tmimi is a tech-

growth, in the range of US$11 billion to front-end space. nology and market analyst for

US$12 billion for the 2017–2019 period, mostly Even as 5G is advancing, however, geopolit- the RF Devices & Technologies

driven by OEMs’ willingness to include LTE ical issues are forcing a paradigm shift. group at Yole Développement.

advanced support in their products. As a result, Indeed, the U.S.-China trade war has led

most of the growth came from flagship phones. to commercial sanctions against one of the Antoine Bonnabel is a technol-

In calendar year 2020, the penetration of leading OEMs, Huawei. That company today ogy and market analyst focused

5G affected not only flagship phones but also is in a tough situation and will survive only if on RF devices and related technol-

mid-tier and entry-level phones. As a result, it manages to develop an alternative supply ogies and markets for the Power

the RF front-end market jumped to US$14 chain without U.S.-based technologies. It & Wireless division at Yole Développement.

www.eetimes.eu | JUNE 2021