Page 36 - EE Times Europe Magazine – June 2024

P. 36

36 EE|Times EUROPE

What Is Nvidia Doing in Automotive?

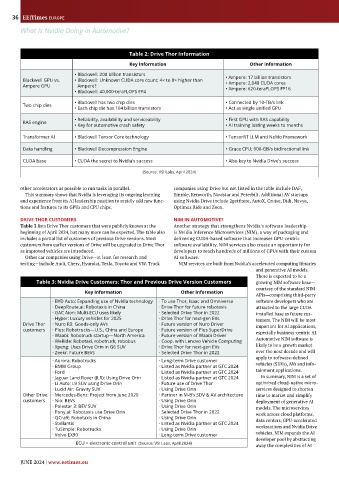

Table 2: Drive Thor Information

Key Information Other Information

• Blackwell: 208 billion transistors

Blackwell GPU vs. • Blackwell: Unknown CUDA core count; 4× to 8× higher than • Ampere: 17 billion transistors

• Ampere: 2,048 CUDA cores

Ampere GPU Ampere? • Ampere: 620-teraFLOPS FP16

• Blackwell: 40,000-teraFLOPS FP4

• Blackwell has two chip dies • Connected by 10-TB/s link

Two chip dies

• Each chip die has 104 billion transistors • Act as single unified GPU

• Reliability, availability and serviceability • First GPU with RAS capability

RAS engine

• Key for automotive crash safety • AI training lasting weeks to months

Transformer AI • Blackwell Tensor Core technology • TensorRT LLM and NeMo Framework

Data handling • Blackwell Decompression Engine • Grace CPU; 900-GB/s bidirectional link

CUDA base • CUDA the secret to Nvidia’s success • Also key to Nvidia Drive’s success

(Source: VSI Labs, April 2024)

other accelerators as possible to run tasks in parallel. companies using Drive but not listed in the table include DAF,

This summary shows that Nvidia is leveraging its ongoing learning Einride, Kenworth, Navistar and Peterbilt. Additional AV startups

and experience from its AI leadership position to rapidly add new func- using Nvidia Drive include 2getthere, AutoX, Cruise, Didi, Navya,

tions and features to its GPUs and CPU chips. Optimus Ride and Zoox.

DRIVE THOR CUSTOMERS NIM IN AUTOMOTIVE?

Table 3 lists Drive Thor customers that were publicly known at the Another strategy that strengthens Nvidia’s software leadership

beginning of April 2024, but many more can be expected. The table also is Nvidia Inference Microservices (NIM), a way of packaging and

includes a partial list of customers of previous Drive versions. Most delivering CUDA-based software that increases GPU-centric

customers from earlier versions of Drive will be upgraded to Drive Thor software availability. NIM services also create an opportunity for

as improved vehicles are introduced. developers to reach hundreds of millions of GPUs with their custom

Other car companies using Drive—at least for research and AI software.

testing—include Audi, Chery, Hyundai, Tesla, Toyota and VW. Truck NIM services are built from Nvidia’s accelerated computing libraries

and generative AI models.

There is expected to be a

Table 3: Nvidia Drive Customers: Thor and Previous Drive Version Customers growing NIM software base—

courtesy of the standard NIM

Key Information Other Information

APIs—comprising third-party

· BYD Auto: Expanding use of Nvidia technology · To use Thor, Isaac and Omniverse software developers who are

· DeepRoute.ai: Robotaxis in China · Drive Thor for future robotaxis attracted to the large CUDA

· GAC Aion: Multi-ECU uses likely · Selected Drive Thor in 2022 installed base as future cus-

· Hyper: Luxury vehicles for 2025 · Drive Thor for next-gen EVs tomers. The NIM will be most

Drive Thor · Nuro R3: Goods-only AVs · Future version of Nuro Driver important for AI applications,

customers · Plus: Robotrucks—U.S., China and Europe · Future version of Plus SuperDrive especially business-centric AI.

· Waabi: Robotruck startup—North America · Future version of Waabi Driver

· WeRide: Robotaxi, robotruck, robobus · Coop. with Lenovo Vehicle Computing Automotive NIM software is

· Xpeng: Uses Drive Orin in G6 SUV · Drive Thor for next-gen EVs likely to be a growth market

· Zeekr: Future BEVs · Selected Drive Thor in 2022 over the next decade and will

apply to software-defined

· Aurora: Robotrucks · Long-term Drive customer

· BMW Group · Listed as Nvidia partner at GTC 2024 vehicles (SDVs), AVs and info-

· Ford · Listed as Nvidia partner at GTC 2024 tainment applications.

· Jaguar Land Rover (JLR): Using Drive Orin · Listed as Nvidia partner at GTC 2024 In summary, NIM is a set of

· Li Auto: L9 SUV using Drive Orin · Future use of Drive Thor optimized cloud-native micro-

· Lucid Air: Gravity SUV · Using Drive Orin services designed to shorten

Other Drive · Mercedes-Benz: Project from June 2020 · Partner in M-B’s SDV & AV architecture time to market and simplify

customers · Nio: BEVs · Using Drive Orin deployment of generative AI

· Polestar 3: BEV SUV · Using Drive Orin models. The microservices

· Pony.ai: Robotaxis use Drive Orin · Selected Drive Thor in 2022 work across cloud platforms,

· QCraft: Robotaxis in China · Using Drive Orin data centers, GPU-accelerated

· Stellantis · Listed as Nvidia partner at GTC 2024

· TuSimple: Robotrucks · Using Drive Orin workstations and Nvidia Drive

· Volvo EX90 · Long-term Drive customer vehicles. NIM expands the AI

developer pool by abstracting

ECU = electronic control unit (Source: VSI Labs, April 2024) away the complexities of AI

JUNE 2024 | www.eetimes.eu